Free Printable Budget Sheets

When you sit down to pay bills do you know ahead of time whether or not you have enough money in your bank account to pay them?

Or, are you adding and subtracting in your head to see if you can pay everything by their due dates?

If you don’t easily know these things, it sure can be a tough way to live.

I’ve been budgeting for my family for 30 years. Now that doesn’t mean I’ve always stuck to the budget, but I’ve always had a target to shoot for.

Let me explain how this method of budgeting (sort of a zero based budgeting) can work really well for you too because you’ll know exactly how much you have available for each bill when they’re due.

It starts with:

- what you get paid

- when you get paid

- what bills are due monthly, quarterly or yearly

- what expenses are likely to come up in the future like health care, car expenses, home maintenance, etc…

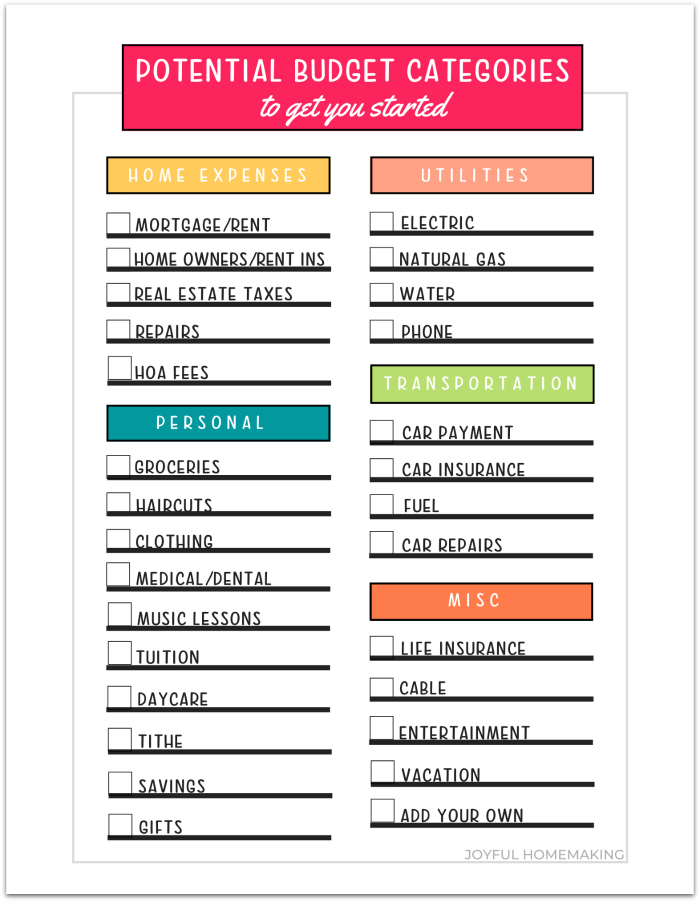

So first, write down what bills/categories you have expenses in each month, quarter or year (like real estate taxes) etc… and then things you want to save for like home or car repairs etc…If you’re able, it’s nice to be able to save for vacations and holidays also. In this way of budgeting you are assigning all of your paycheck to specific categories while keeping your expenses equal to or less than your income.

I’ve made a printable with potential expenses you may have.

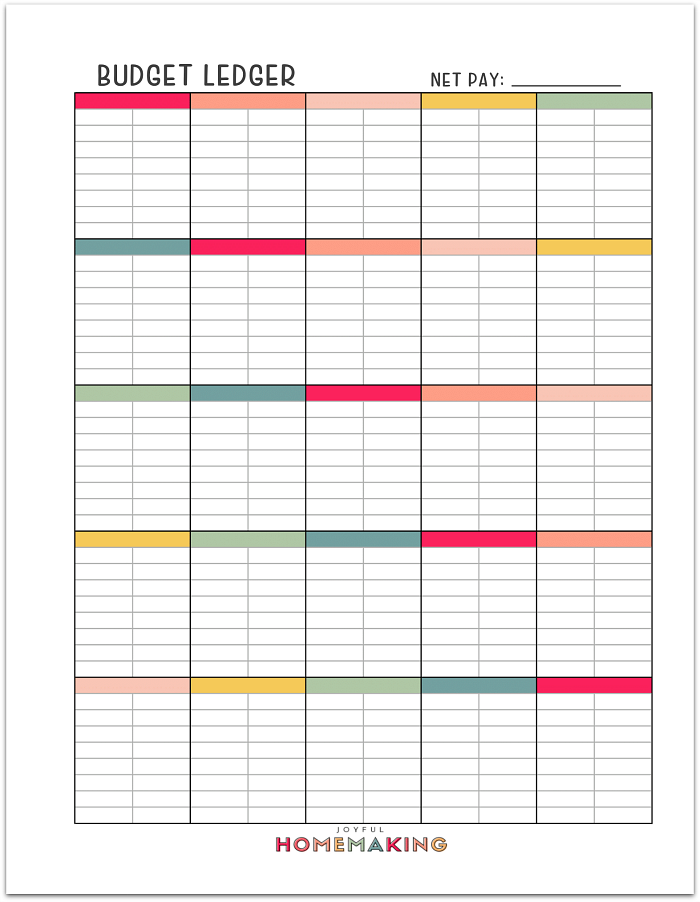

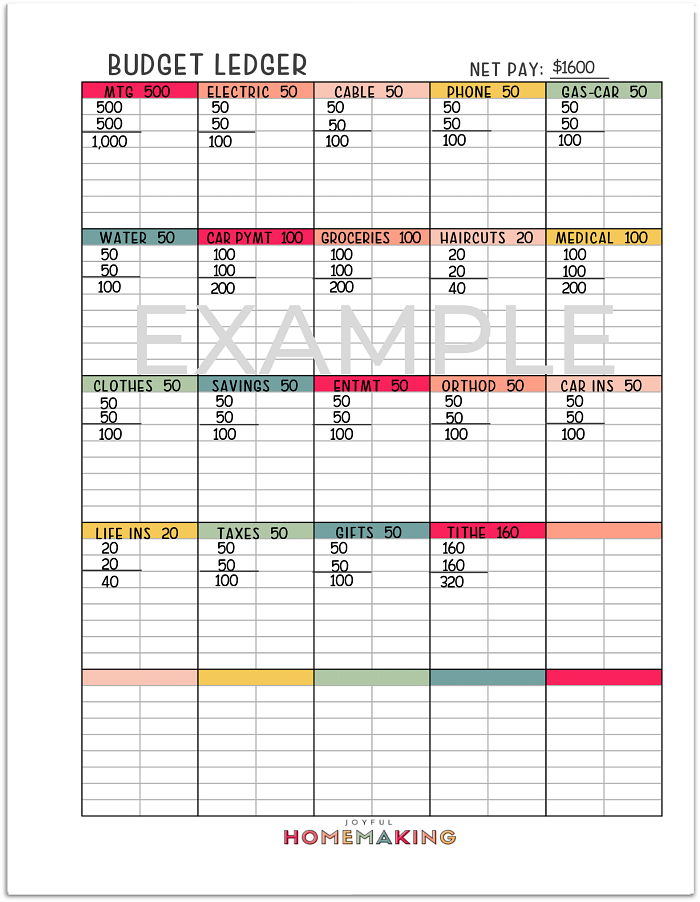

After you’ve determined your bills and spending categories, decide what the average cost (or the highest potential cost) is for each one monthly, and then divide that amount by the number of paychecks you get in each month. You can keep track with this printable ledger.

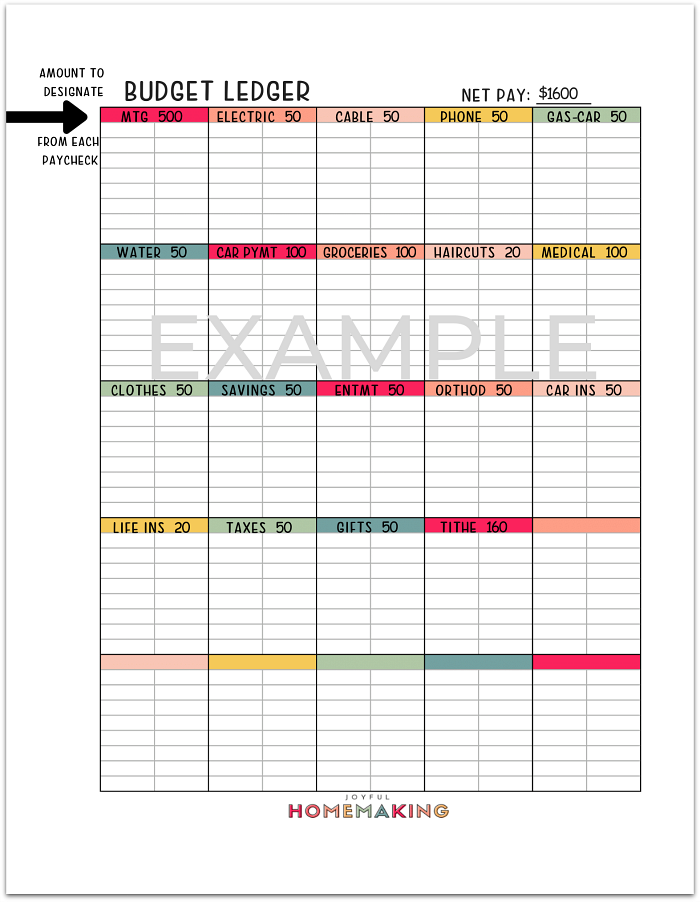

So for example, if your family gets paid every other Friday, so basically twice a month, here is a simulated example to show you the process.

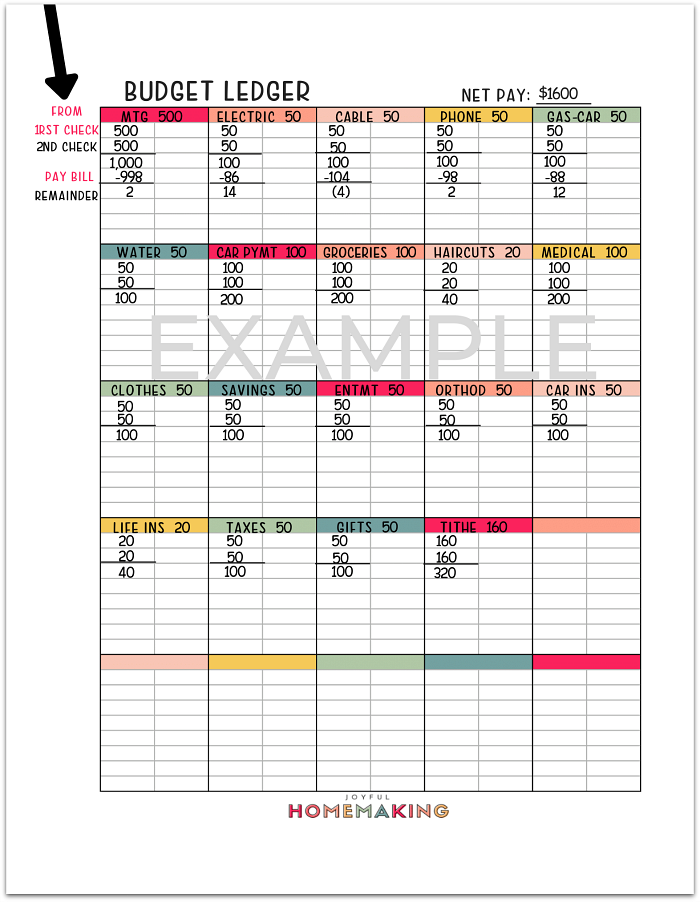

On the budget ledger page you will write down:

- each of your bill categories

- categories you’d like to save for

- the amount to designate from your checking account each paycheck for each category

On the example, the net pay for one out of two paychecks a month is: $1600 ($3200 for the whole month).

So for each monthly bill, you would divide the amount needed by 2, and take that amount out of each of the 2 monthly paychecks. If the mortgage is $1000 a month, and you get paid twice a month, you would designate $500 out of each paycheck for that bill.

For other bills like real estate taxes that may be due twice a year, you can take the amount you would pay every 6 months, in our example $600, and divide that by 6 which would be $100 a month. Since theoretically you get paid 2 times a month, you would divide that by 2, which means you assign $50 out of each paycheck to go towards taxes. That way when they’re due, the money is set aside in your account and available.

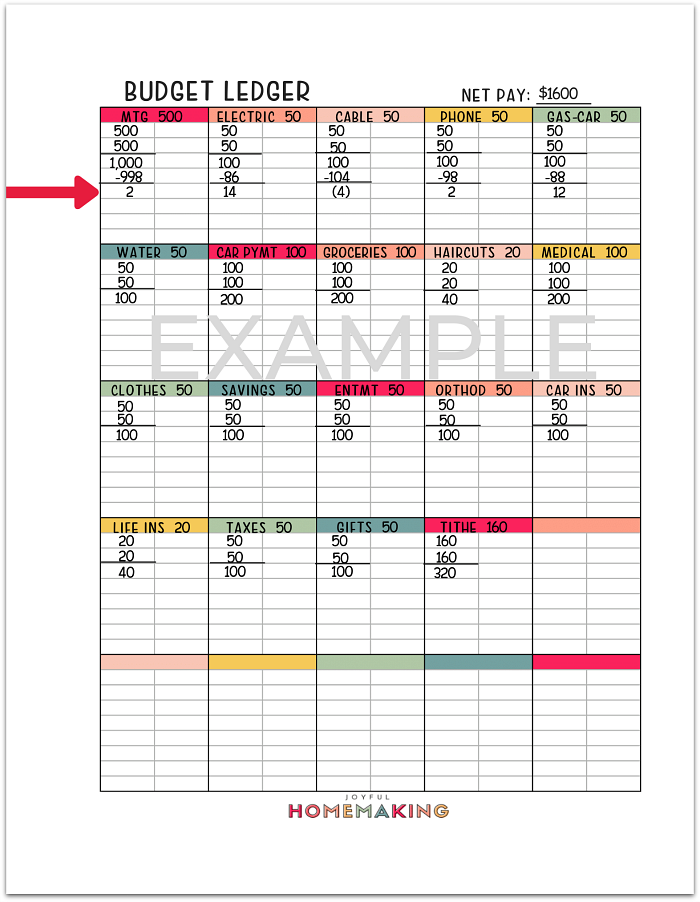

Whether you use a debit card, checks, or online bill pay, when you buy or pay something, you will subtract it from the matching category on your budget sheet and your checking account.

You can see in the example below that after the mortgage was paid for the month, there was $2 left in that category till the next paycheck. In electric there was $14 left over. The cable bill was a little higher than estimated. So if I wanted I could subtract the extra from the electric category to make a zero balance in cable, or if I know that sometimes my cable bill is lower than $100, I could just wait till it evens out, if there’s a cushion of cash in the account.

When you’re first starting out with this way of budgeting, if you can, it’s good to have some cushion money in the account you pay your bills from because, the timing may be off from when you start budgeting this way to when a bill is due, and you may not have enough money built up in that category to pay the bill in full yet. You don’t want to overdraw!

To keep up with everything, I like to “balance” or reconcile my checking account and my budget ledger weekly, but at the very least, be sure and do it every paycheck.

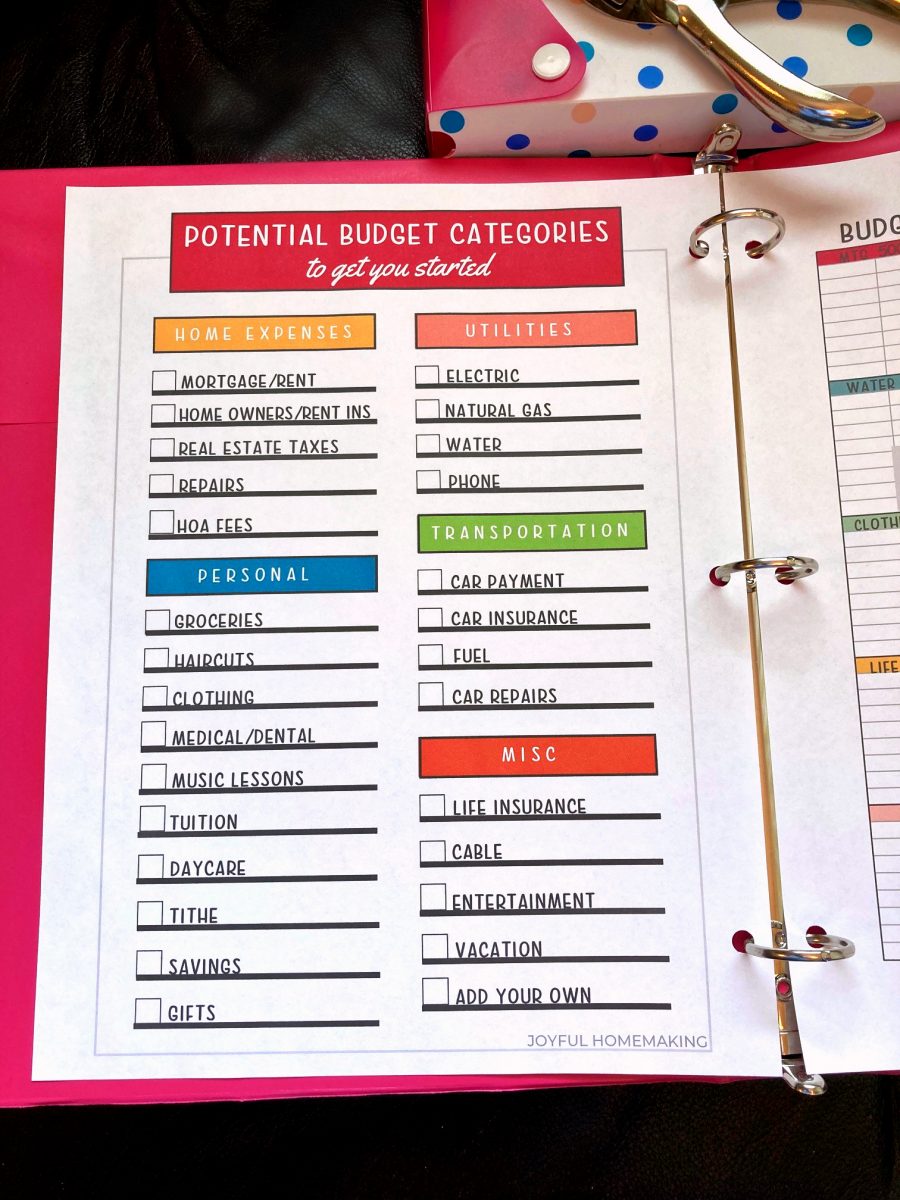

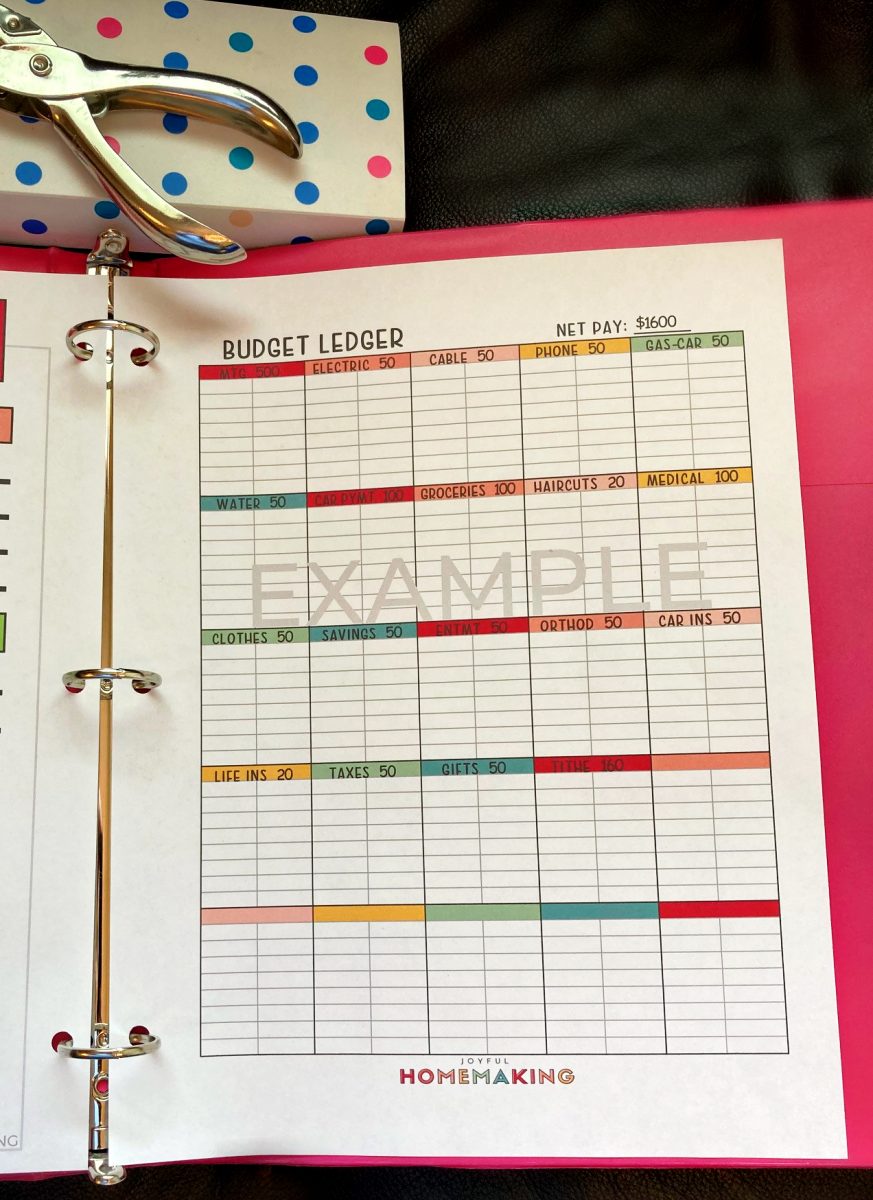

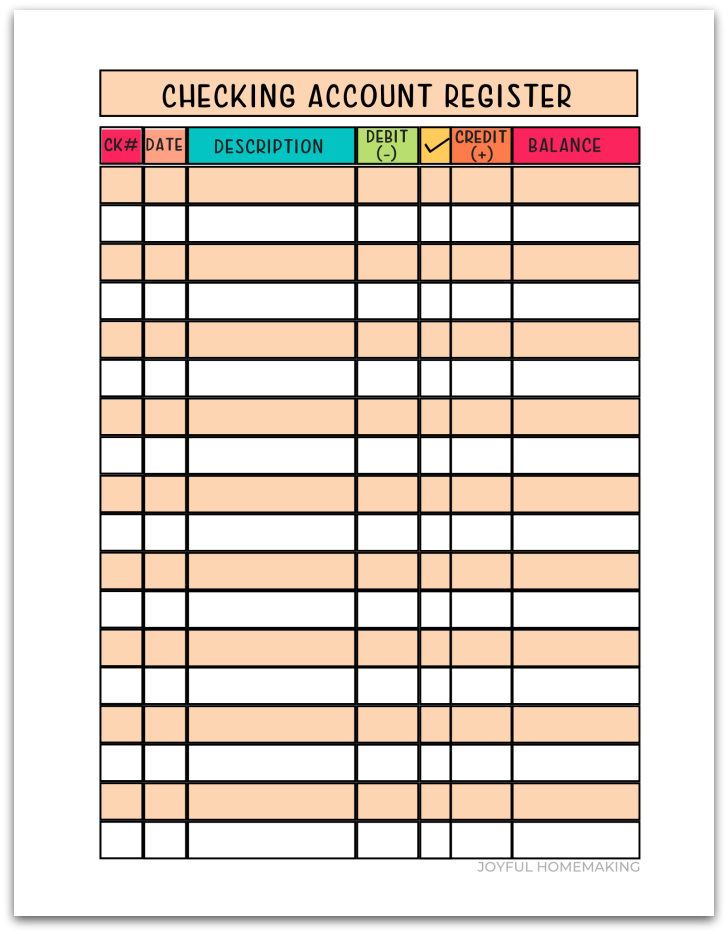

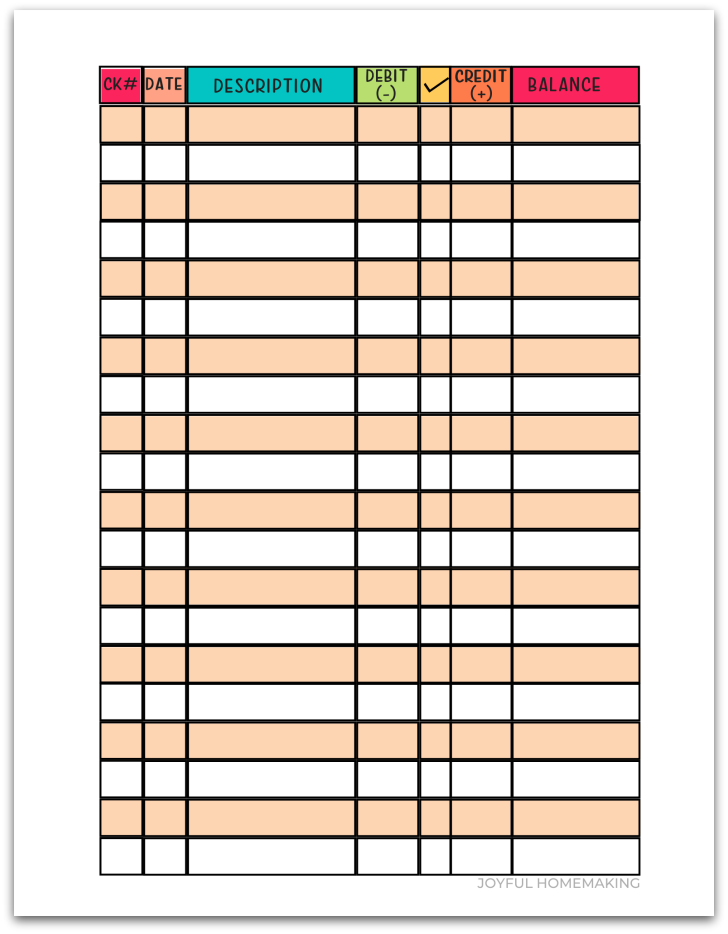

For myself, I keep the printable budget ledger in a 3 ring binder with my checking ledger. Our check is automatically deposited straight to our checking account. Because I pay my bills online, I hardly ever need to write a check. But when I do, instead of using the little ledger that comes with a box of printed checks, I keep track with a full page checking ledger in my notebook along with my budget sheet. You can also print one below.

On the Friday’s that we get paid:

- I update my budget sheet with the “cash” to each category

- Pay any bills that are upcoming

- Subtract the amounts from the checking account register page

If I’ve done my math correctly, when I add all of the remaining totals from my budget sheet, that number should equal the balance in my checking account (plus any cushion in the account).

Even though I can check my account online any time, the paper ledger is easy for keeping track of where all the money in my account is designated. There are online ways to do this, but for me I like writing it down because I don’t have to learn another computer program. If that’s your thing though, this ledger system could be done online with any number of programs or an Excel spreadsheet.

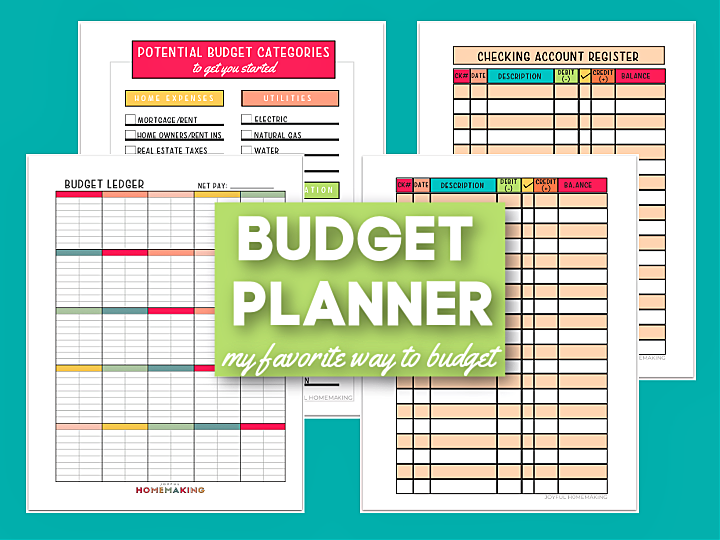

Here are the printables I’ve created to help you get started.

- Blank Budget Printable

- Example Budget

- Potential Budget Categories

- Checking Account Register

- Checking Account Register pg 2

Now what do you do if your paycheck is less than all of the bills and categories you want to save for?

You can either:

- Try and lower your flexible bills/expenses

- Try and increase your income/cash flow

There are different seasons in life for each of us and not all of them are as bountiful as we might wish, but we do the best we can with what we have. Don’t let this discourage you, but let budgeting help you to see exactly where your money is going, and how to use what you have as wisely as you can.

If you’re used to living paycheck to paycheck and then you convert to this way of designating your money to categories and saving for future expenses, you will be so excited that when it comes time to pay for seasonal or irregular bills, you can look at your ledger and see that you have saved what you need to pay that expense.

This method of budgeting has worked so well for my family, and if this is helpful to you, I’d love to hear from you!

Super cute budget sheets! Budgeting has helped my husband and I pay off my student loans in only 4 years as well as accomplish many of our other financial goals. I hope people take advantage of these sheets! =D

This budget planner is perfect for me since I am very in to organizing stuffs and budgeting as well for the family. I recommend this to all moms out there.

Thank you so much for making this free ledger available. My 14 year old grandson is rebuilding an engine in an old truck. I wanted him to keep track of money spent so he would know what the project cost. I could not find a one page I could print without cost.. I am a grandparent and wanted to have it available when he came to work on the truck. He worked all summer and put all his cash in the project, we gave him some money for the engine block. Besides learning to be a mechanic I want him to know the value of keeping track of expenses.

Thank you for your kind words. I’m so glad you’re finding it helpful! 🙂